When it comes to personal finance, having the right tips and strategies can make a significant impact on your financial health. By implementing smart money-saving techniques, you can build a solid foundation for your future financial well-being. In this article, we will explore some insightful personal finance tips to help you save money and achieve your financial goals.

Creating a Budget for Financial Success

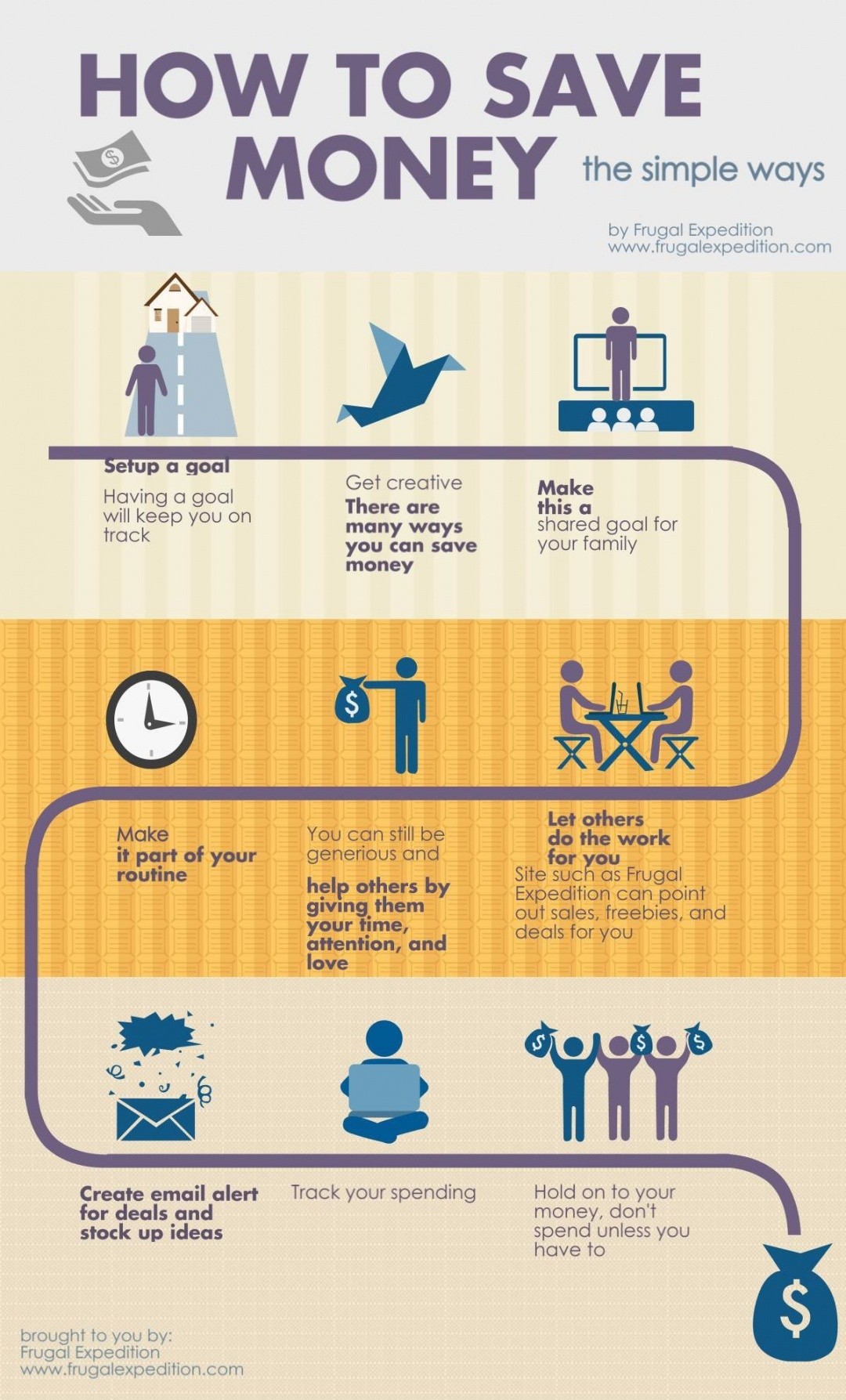

One of the fundamental principles of personal finance is establishing a budget. A budget allows you to track your income and expenses, giving you a clear overview of where your money is going. By creating a budget, you can identify areas where you can cut back on spending and prioritize saving for your financial goals.

Setting Realistic Financial Goals

Setting realistic financial goals is essential for effectively managing your money. Whether you are saving for a big purchase, such as a house or a car, or planning for retirement, having clear financial goals can help you stay motivated and focused on your long-term objectives. When setting financial goals, make sure they are specific, measurable, achievable, relevant, and time-bound.

Building an Emergency Fund

Unexpected expenses can derail your financial plans if you are not prepared. Building an emergency fund is crucial for dealing with unforeseen circumstances, such as medical emergencies, car repairs, or job loss. Aim to save at least three to six months’ worth of living expenses in your emergency fund to provide financial security and peace of mind.

Tracking Your Expenses

Tracking your expenses is a powerful tool for understanding your spending habits and identifying areas where you can cut costs. By keeping a record of all your expenses, you can easily pinpoint unnecessary purchases and make informed decisions about where to allocate your money. Use online tools or apps to simplify the process of tracking your expenses and monitoring your financial progress.

Limiting Impulse Purchases

Impulse purchases can quickly drain your bank account and lead to unnecessary debt. To avoid falling into the trap of impulse buying, practice mindfulness and self-discipline when making purchasing decisions. Before making a purchase, ask yourself if it aligns with your financial goals and if it is a necessity or a want. By being mindful of your spending habits, you can save money and avoid unnecessary financial stress.

Automating Your Savings

Automating your savings is an effective way to consistently save money without having to think about it. Set up automatic transfers from your checking account to your savings account or investment account to ensure that you are regularly saving a portion of your income. By automating your savings, you can make saving a priority and build a strong financial foundation for the future.

Comparing Prices Before Making Purchases

Shopping around and comparing prices before making purchases can help you find the best deals and save money on everyday expenses. Whether you are buying groceries, clothing, or electronics, take the time to research prices and look for discounts or promotions. By being a savvy shopper, you can stretch your dollars further and make the most of your budget.

Investing for the Future

Investing is a key component of building wealth and achieving long-term financial success. Whether you are investing in stocks, bonds, real estate, or retirement accounts, investing allows your money to grow over time and generate passive income. Consider working with a financial advisor to develop an investment strategy that aligns with your financial goals and risk tolerance.

Reviewing and Adjusting Your Financial Plan

Financial planning is not a one-time task but an ongoing process that requires regular review and adjustment. Periodically review your financial goals, budget, and investment portfolio to ensure that they are still aligned with your current financial situation and future aspirations. Make necessary adjustments to your financial plan as needed to stay on track and continue making progress towards your goals.

Conclusion

By implementing these personal finance tips, you can take control of your finances, save money, and work towards achieving your financial goals. Whether you are just starting on your financial journey or looking to improve your current financial situation, following these strategies can help you build a secure financial future and enjoy peace of mind knowing that you are on the right path to financial success.